The Ultimate Guide To Paul B Insurance

Wiki Article

Things about Paul B Insurance

stands for the terms under which the case will be paid. With residence insurance policy, as an example, you might have a substitute price or real money worth policy. The basis of how cases are cleared up makes a huge influence on exactly how much you get paid. You must always ask exactly how cases are paid and what the cases process will be.

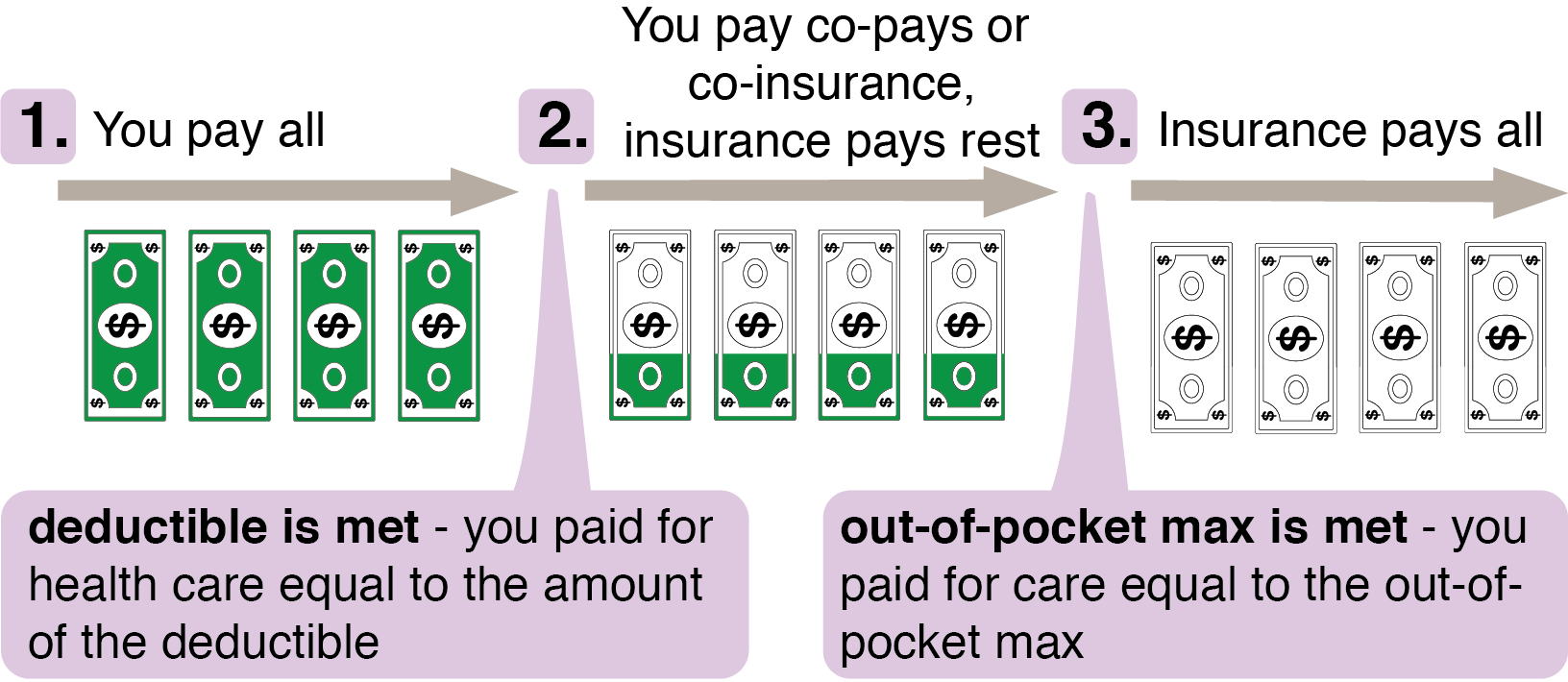

They will videotape your insurance claim and explore it to find out what occurred and also how you are covered. Once they determine you have a covered loss, they may send out a check for your loss to you or maybe to the service center if you had an auto accident. The check will certainly be for your loss, minus your insurance deductible.

The thought is that the cash paid in cases in time will certainly be much less than the overall costs accumulated. You might really feel like you're throwing money out the home window if you never file a case, yet having piece of mind that you're covered on the occasion that you do endure a considerable loss, can be worth its weight in gold.

Paul B Insurance for Dummies

Imagine you pay $500 a year to insure your $200,000 home. This means you have actually paid $5,000 for residence insurance coverage.

Because insurance coverage is based on spreading out the threat amongst lots of people, it is the pooled cash of all people paying for it that permits the firm to develop possessions and cover cases when they occur. Insurance coverage is a service. Although it would certainly behave for the business to just leave prices at the exact same level regularly, the fact is that they have to make enough cash to cover all the prospective claims their policyholders may make.

Underwriting changes and price increases or reductions are based on outcomes the insurance policy company had in previous years. They market insurance policy from only one business.

An Unbiased View of Paul B Insurance

The frontline people you manage when you purchase your insurance coverage are the representatives and also go to this site brokers that stand for the insurance provider. They will certainly clarify the kind site here of items they have. The restricted representative is an agent of just one insurance coverage business. They an acquainted with that business's products or offerings, but can not speak towards other companies' plans, prices, or item offerings.

he has a good pointThey will have accessibility to greater than one business as well as should understand about the variety of products provided by all the firms they represent. There are a few essential inquiries you can ask yourself that could assist you choose what type of insurance coverage you require. Exactly how much risk or loss of cash can you assume on your own? Do you have the cash to cover your prices or financial debts if you have a mishap? What about if your residence or car is ruined? Do you have the financial savings to cover you if you can't function as a result of an accident or disease? Can you afford higher deductibles in order to lower your expenses? Do you have unique requirements in your life that require additional insurance coverage? What concerns you most? Policies can be customized to your needs as well as determine what you are most worried concerning securing.

The insurance policy you need differs based on where you go to in your life, what type of assets you have, as well as what your long-term goals and also tasks are. That's why it is crucial to take the time to review what you desire out of your policy with your representative.

How Paul B Insurance can Save You Time, Stress, and Money.

If you get a lending to get a car, and afterwards something occurs to the auto, void insurance will repay any portion of your car loan that conventional automobile insurance policy doesn't cover. Some loan providers require their customers to bring space insurance coverage.

The major function of life insurance coverage is to offer cash for your beneficiaries when you pass away. Depending on the kind of policy you have, life insurance can cover: Natural fatalities.

Life insurance policy covers the life of the insured individual. Term life insurance coverage covers you for a period of time chosen at acquisition, such as 10, 20 or 30 years.

The Main Principles Of Paul B Insurance

Term life is prominent because it offers large payouts at a reduced expense than long-term life. There are some variants of common term life insurance policy policies.

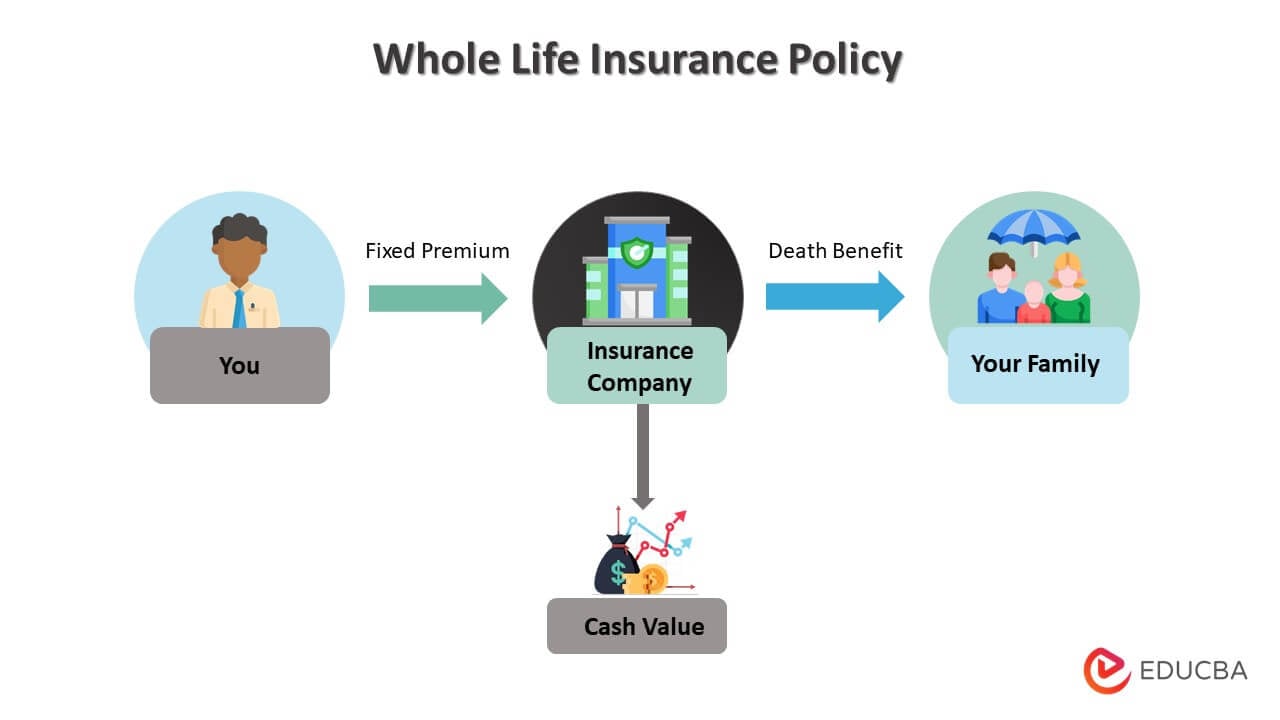

Long-term life insurance coverage plans construct cash value as they age. The money value of entire life insurance policies grows at a fixed rate, while the cash money worth within global plans can vary.

$500,000 of whole life insurance coverage for a healthy 30-year-old female costs around $4,015 each year, on average. That very same level of insurance coverage with a 20-year term life policy would certainly cost an average of concerning $188 every year, according to Quotacy, a broker agent firm.

7 Simple Techniques For Paul B Insurance

Nevertheless, those investments feature more threat. Variable life is an additional permanent life insurance policy option. It seems a whole lot like variable universal life however is actually various. It's an alternate to entire life with a fixed payout. Nonetheless, insurance holders can utilize financial investment subaccounts to expand the cash value of the policy.

Below are some life insurance policy fundamentals to aid you much better understand just how insurance coverage functions. For term life policies, these cover the cost of your insurance and management expenses.

Report this wiki page